Freshbooks is a cloud-based accounting and finance software company. Their software allows you to manage your invoices and collect online payments for your small business all at an affordable price.

The company was founded in Toronto, Canada in 2003, by Mike Mcderment, Joe Sawada, and Levi Cooperman to help small to medium sized businesses manage their finances. Mike Mcderment is the current CEO and manages over 200 staff members.

Over 24 million people have used Freshbooks. Most of these people are self-employed business owners or freelancers. In this review I will go everything you need to know about Freshbooks, how much it costs and how you can get a free 30 day trial.

Disclaimer: Some of the links above are affiliate links, meaning, we will earn a commission if you click through and download the app.

What is Freshbooks

Now if you’re still wondering what Freshbooks is, here is a little more detail. Besides from winning the best accounting software award for 2018, Freshbooks helps business owners streamline their client invoices as well as help set up recurring payments in minutes.

As mentioned before the software was built with small business owners in mind, so the focus is making their product simple and easy to use. With that being said you do not need any experience in accounting to use it, it’s as simple as plugging in some numbers and printing out your professional invoices.

You can even customize your invoices by adding your branding. Simply modify the design, colors, and you can even add you logo to make it look more professional and formal.

Freshbooks also automates some features such as follow ups with clients, time tracking of invoices, and expense organization. The software can also integrate with the most popular third-party apps/platforms such as Google’s G Suite, Shopify, Stripe, and PayPal.

Freshbooks Pricing Plans

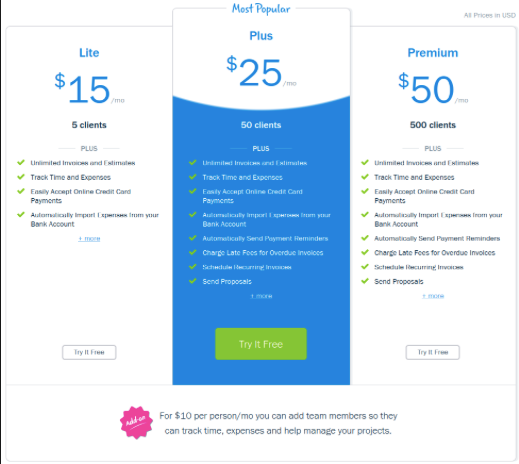

One of the most common questions asked is, “how much does Freshbooks cost?” And the answer is it depends on the plan you chose. Freshbooks currently has three plans to choose from.

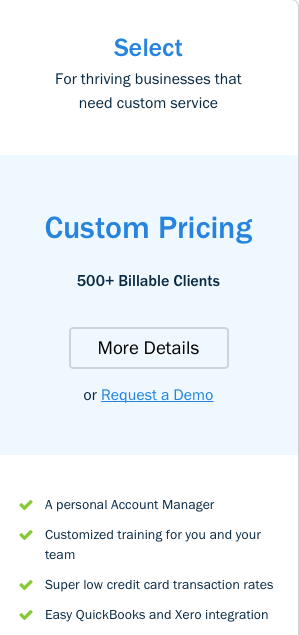

They are Lite, Plus, and Premium. If you have a larger business that invoices $150,000 a year or have over 500 billable clients you can also get a custom quote package called “Select”. Before ever paying or enter your credit card information you can try Freshbooks free for 30 days.

The Lite plan is $15 a month or $13.50 a month if you pay yearly. The Plus plan is $25 a month or $22.50 a month if paid yearly. And the Premium plan is $50 a month or $45 a month when you pay yearly.

If you pay yearly you will get 10% off. Each package offers the basic features such as invoicing, payment processing, and time tracking.

Freshbooks Lite plan includes unlimited and customized invoices up to 5 billable clients, unlimited expense reports, time tracking, estimates, accept online credit card payments, automated bank import, and tax time reports.

Freshbooks Plus plan offers all of the same features as the Lite plan but up to 50 billable clients as well as unlimited proposals, schedule late fees, automated recurring invoices, double entry accounting reports, and automated late payment reminders.

Freshbooks Premium plan has all of the features from both the Lite and Plus plan but allows you to manage up to 500 billable clients.

The Freshbooks Select plan or custom quote offers everything from the 3 packages as well as a personal account manager, custom training, low credit card transaction rates, and easy quickbooks. Xero integration.

Before buying you can even schedule a demo to make sure this is the right package for you, prices will vary.

Ever plan and even the free plan comes with their award winning customer service support. You can call anytime from 8am-8pm EST. Freshbooks phone number is 1–866–303–6061 in case you need help signing up or managing their website.

Freshbooks Free Trial

As previously mentioned before even buying a plan you can enroll in a free 30 day trial. You can try and test out all of the features and even contact support with any questions you may have.

There currently isn’t a forever free plan, but we are confident that after you try it you’ll join a paid plan which are very competitively priced.

Freshbooks Classic

Freshbooks introduced a new verizon of their product and are encouraging all of their classic users to upgrade to the new edition.

The new Freshbooks is more up to date with a slick design and is more mobile and user friendly. With its sleek new interface and more customizable invoices upgrading to the new layout offers many benefits and less headaches.

To be clear the Freshbooks classic view is still available to existing clients but these plans are not being offered to new customers.

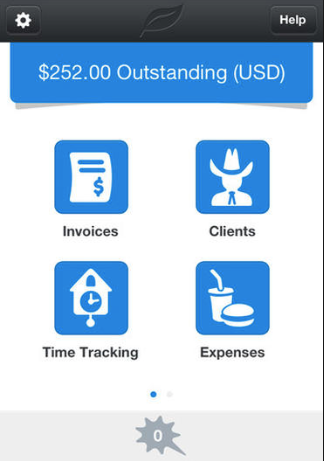

Freshbooks App

Most business owners are usually on the go, so Freshbooks created a mobile app to help those who are constantly on the go or may not have access to their computer.

The app is available for both IOS and Android. All of the same great features on the desktop view are available on your mobile device including sending invoices, logging expenses, tracking time, receiving updates and even chatting with clients.

The best part is all the information is synced across all of your devices allowing you to work anywhere, and anytime.

Freshbooks Benefits

- User and mobile responsive - With their fresh new design and mobile app Freshbooks designed their website with the user in mind. Once you log into your account you’ll see how easy to navigate the site is and how easy it is to create a report. If you are on the run simply download the mobile app and have access to the same great experience just with a smaller screen.

- Time saving features - To save you time you can set up a billing schedule. Set up automatic payments with the auto billing feature and charge your clients effortlessly and with full security. You can even set alerts for late payments, so you can notify your clients who are behind on payments and even charge them a late fee.

- Track open invoice rates - Freshbooks has a great feature where they can track when your clients receive your invoices and opens them. This helps eliminate the excuse of them not receiving your invoice.

- Flexible payment options - Freshbooks allows you to accept payments from the top credit cards and online payments. You can accept payments from MasterCard, Visa, American Express, Google Checkout, and PayPal.

- Expense tracking - With Freshbooks you can easily track expenses. Your receipts can be attached and organized in the program and can then be used during tax season. You can categories each expense by client or add it to an invoice to bill later.

- Easy reporting - With just a few clicks enter the data into the software and create professional clean reports again and again. Reports can be exported to a CSV file, Google doc or PDF and saved as a hard copy.

Freshbooks Payments Online

Freshbooks allows you to receive online payments from your clients, which helps increase the efficiency of your business. You can accept payments from your customers via credit cards, Apple Pay and now through ACH (automated clearing house).

Credit cards are great to receive payments, but they do have more expensive fees at 2.9% plus $.30 per transaction. To minimize your transaction fees you can now have your clients pay with their bank account for a 1% fee.

ACH payments are fast and secure and can help you reduce transactions fees by more than half. When using ACH the money is automatically deposited into your bank account and automatically tracked and paid in Freshbooks.

ACH helps speed up the process of receiving payments, because you no longer have to wait for checks or for a client to make payments with their cards. If a client is billed the same each month, you can have them set up recurring ACH payments from their bank account.

ACH is also better than traditional paper checks because it doesn’t require the use of paper and is more eco-friendly.

Automated clearing house payments are an online network that connects bank institutions across the United States. This payment is only offered to US residents only.

For all existing or new Freshbooks customers, it’s highly recommended to encourage your clients to switch to ACH as their primary payment. This way payments are automated, exchanged much quicker, and will help you cut down on the fees you spend for each transaction.

Using ACH payments doesn’t require any changes to your account; it just offers you and your clients another option to do business together. To learn more about these payments from your bank you can check out the payment section here on Freshbook’s website. Be sure to let your clients know about these changes to help you both save on fees.

Freshbooks Alternatives

Although Freshbooks is one of the best cloud based accounting and finance software there are a few other alternatives. Some of the similar software company’s are Quickbooks, Xero, Sage, NetSuite, and Billyapp.

Conclusion

I hope you found my Freshbooks review informative and educational. This is a great accounting software at affordable pricing plans that will help you save time and money to keep your company’s books in check.

If you are new to Freshbooks, still deciding about joining, or have been a customer for a while please share your concerns or experience in the comment section. Just a reminder you can start your free 30 day trial by clicking the link below.